Business Insurance in and around Sterling Heights

Looking for coverage for your business? Look no further than State Farm agent Clint St.Mosley!

This small business insurance is not risky

This Coverage Is Worth It.

Small business owners like you wear a lot of hats. From customer service rep to tech support, you do everything you can each day to make your business a success. Are you a taxidermist, a pet groomer or a piano tuner? Do you own an appliance store, a toy store or a bicycle shop? Whatever you do, State Farm may have small business insurance to cover it.

Looking for coverage for your business? Look no further than State Farm agent Clint St.Mosley!

This small business insurance is not risky

Protect Your Business With State Farm

Your business is unique and faces specific challenges. Whether you are growing an art gallery or a bridal shop, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Clint St.Mosley can help with errors and omissions liability as well as life insurance for a group if there are 5 or more employees.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Clint St.Mosley is here to help you discover your options. Get in touch today!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

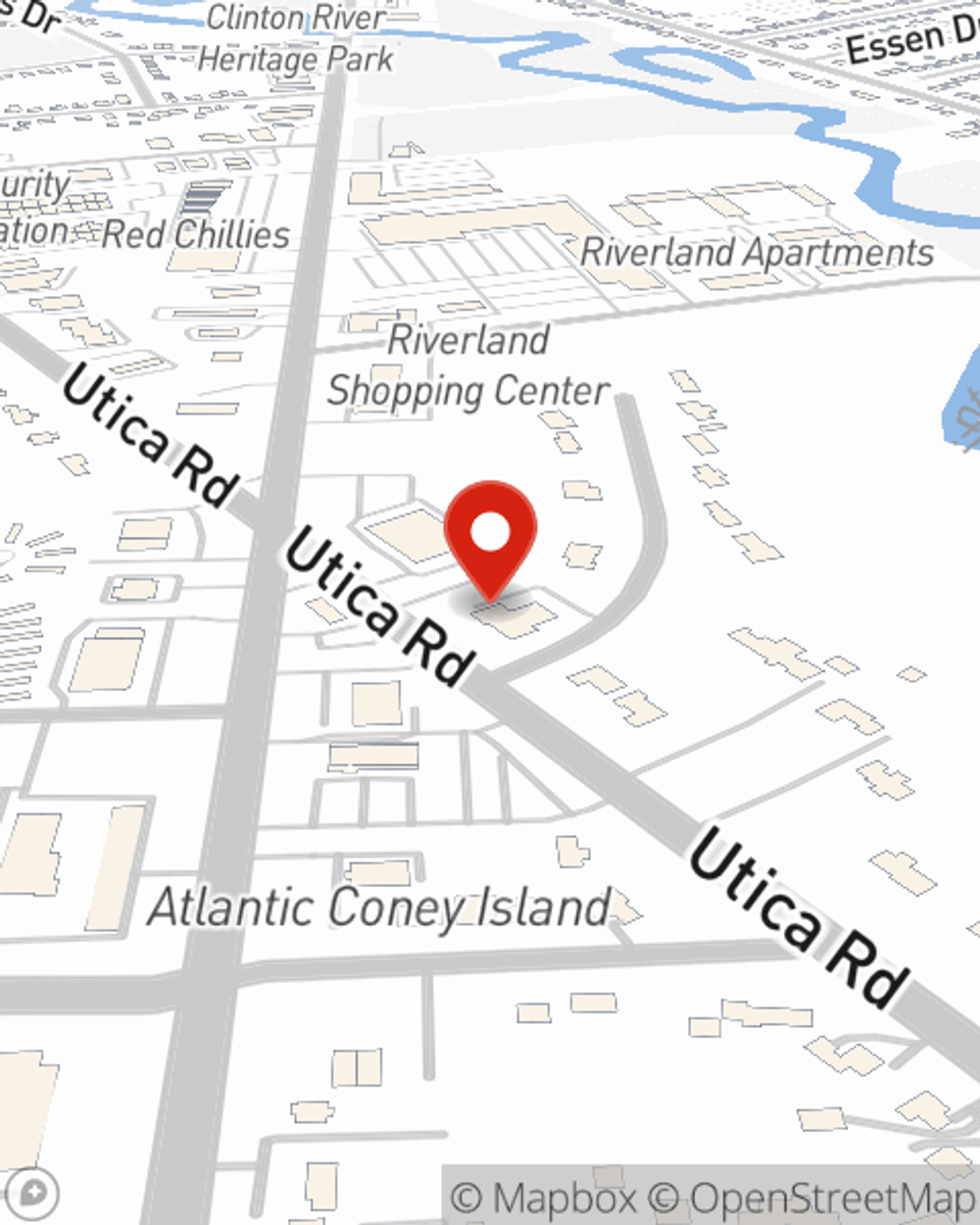

Clint St.Mosley

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.